CREDIT SCITE PLUS

The more your credit history shows may be able to responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.ĭid you know? Wells Fargo offers eligible customers free access to their FICO ® Score ― plus tools, tips, and much more. Ultimately, one way to potentially improve improve your credit score is to use loans and credit cards responsibly and make prompt payments. Credit scoring models are also built to recognize that recent loan activity does not mean a consumer is necessarily risky. If you’ve opened a lot of accounts recently or applied to open accounts, it may suggest potential financial trouble and may lower your score. Recent credit activity makes up the final 10%.Having a mix of accounts, including installment loans, home loans, and retail and credit cards may help improve your score. The types of accounts you have make up 10% of your score.It may seem wise to avoid applying for credit and carrying debt, but it may actually hurt your score if lenders have no credit history to review. This is why you might consider keeping your accounts open and active.

Credit scoring models generally look at the average age of your credit when factoring in credit history. The longer your history of making timely payments, the higher your score will be.

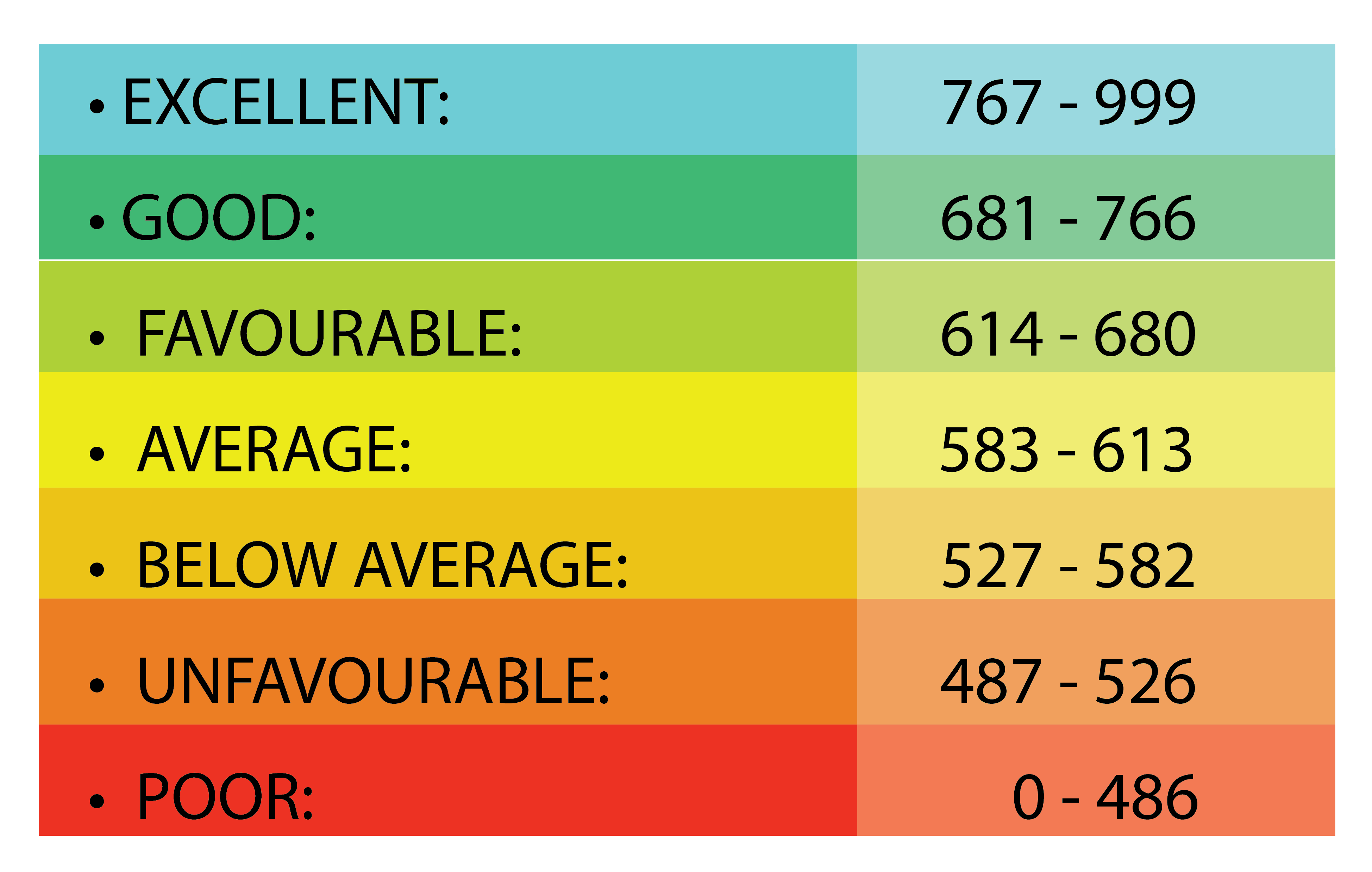

How far behind you are on a bill payment, the number of accounts that show late payments and whether you've brought the accounts current are all factors. Payments made over 30 days late will typically be reported by your lender and lower your credit scores. You can also request a free copy of your credit report from each of the three major credit reporting agencies, Equifax, Experian, and TransUnion, once a year through. This shows whether you make payments on time, how often you miss payments, how many days past the due date you pay your bills, and how recently payments have been missed. For example, through Experian, you can obtain your free FICO Score. Your payment history accounts for 35% of your score.Your credit score is based on the following five factors: By understanding what impacts your credit score, you can take steps to improve it. For your FICO ® Score, it's a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. Your credit score is one of the most important measures of your creditworthiness.

0 kommentar(er)

0 kommentar(er)